In last years Federal Budget, there was a small statement saying that Tax Residency would be changed, with the potential of someone visiting Australia for just 45 days being classed as a Tax Resident, having a dramatic impact on many expatriates and citizens that have chosen to retire abroad.

We mobilised quickly and created a Parliamentary Petition to seek a rethink by the Government to a more realistic time line. We were very proud to get over 5,730 signatories which carried significant weight to our argument. A quick search on past Tax related Petitions, suggested that this was the highest ever amount of signatories for a Parliamentary Petition in regard to personal tax issues, which in itself is quite a feat.

Click here to view our Petition https://www.aph.gov.au/e-petitions/petition/EN2834

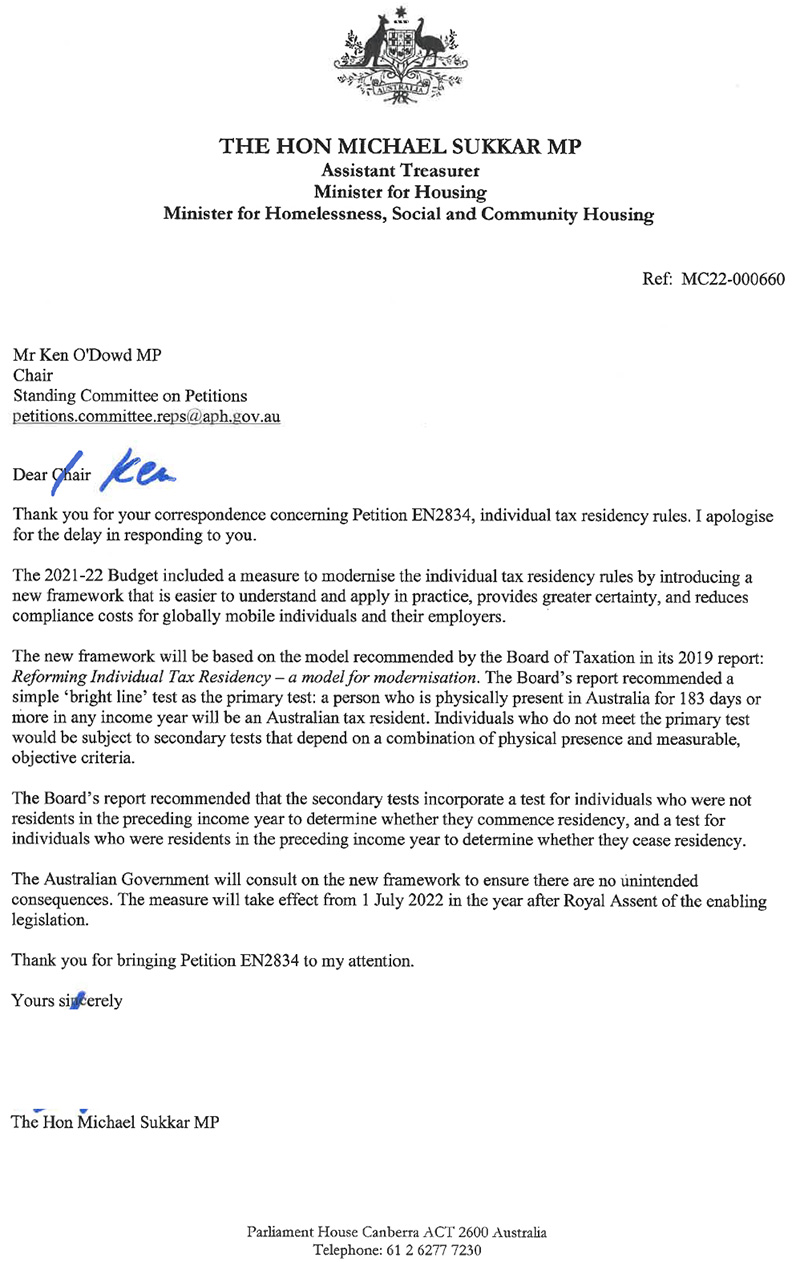

Only this week we finally got a response from the Assistant Treasurer, The Hon Michael Sukkar MP, where he reconfirmed the Governments intentions to bring this in from 1st July 2022, but more importantly stated that “The Australian Government will consult on the new framework to ensure there are no unintended consequences.” (see letter below)

This is indeed encouraging for all of us, and should mean that an appropriate review of the proposed legislation (which has not been released yet) will allow us, and others, to provide valuable feedback and hopefully ensure the final legislation is fair and reasonable for all.

Thanks to everyone who supported the Petition, and I look forward to continuing the battle as we see the draft legislation come to light.