Australian Investment Bond

AU $10,000,000 Bond Offer

About the issue

For Investors seeking regular, fixed coupons over the medium term.

The Australian Investment Bond (the Bond) offers investors a fixed annual return paid half yearly to

Bondholders. SMATS Yield Investments Pty Ltd (the Company) will issue Bonds to raise AU$10,000,000 from accredited investors. Funds raised from the Bond will be used by the Company to invest in credit opportunities within the Australian property market, which are only accessible via SMATS Group and Griffin Projects Group (collectively, referred to as the Group) with a small allocation to liquid investments. Bonds will offer a fixed rate annual Coupon payment to investors of 6.5% p.a. paid quarterly in arrears.

SERIES 1 - AU$10,000,000 - 6.5%p.a. PAID QUARTERLY IN ARREARS - BONDS DUE 2024

Bond Features

Issuer: Bond issued by SMATS Yield Investments Pty Ltd (ACN 624 084 466)

Coupon: Fixed rate coupon payment of 6.5% per annum

Bond Term: 4 Years

Security: Bonds are unsecured obligations of the Issuer that rank before shareholders

Coupon Payments: Paid quarterly in arrears

Bond Holders Fees: Nil

Early Redemptions: Based on Director discretion & no fee payable

Eligibility: Accredited Investors only

Bond Face Value: AU$10,000

Minimum Investment: AU$50,000

Maximum Bond Issue: AU$10,000,000

Minimum Bond Issue: AU $1,000,000

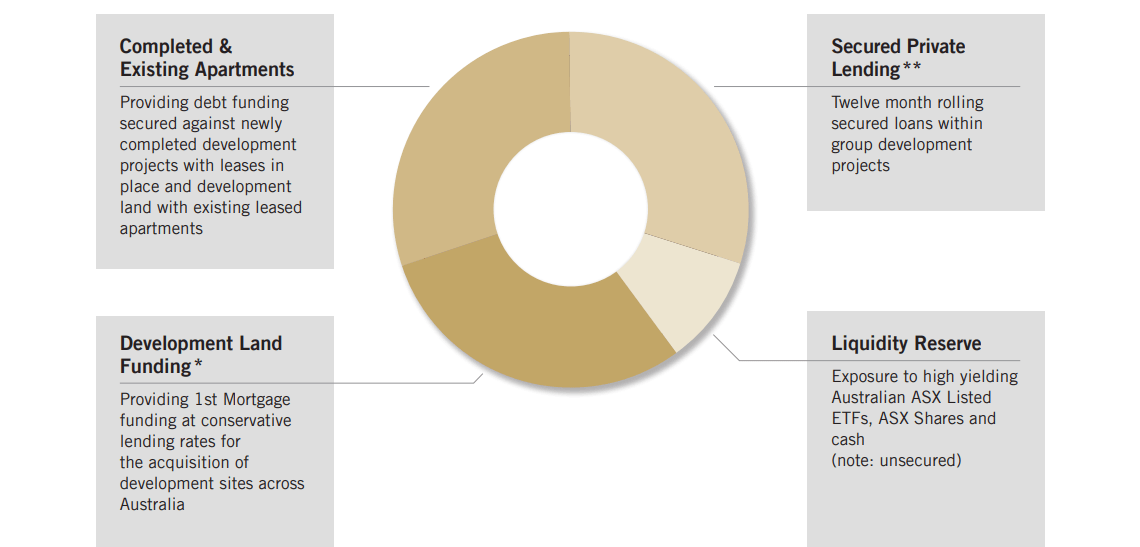

Company Portfolio

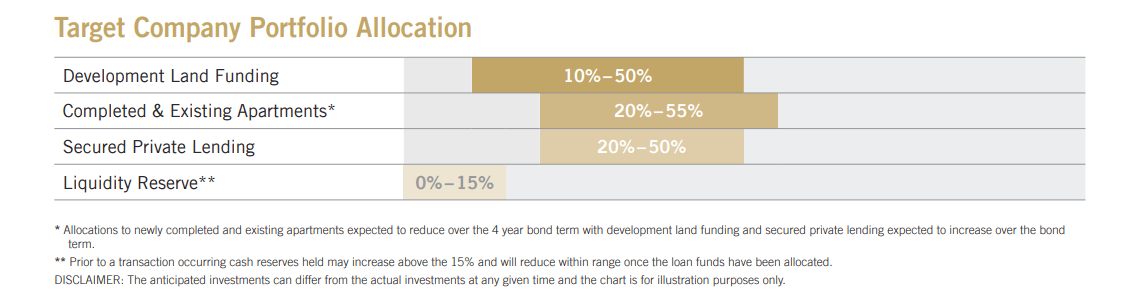

Target Company Portfolio Allocation

Disclaimer: All information provided on this website is of a general nature only and does not take into account your personal financial circumstances or objectives. Before making a decision on the basis of this material, you need to consider, with or without the assistance of a financial adviser, whether the material is appropriate in light of your individual needs and circumstances. The information on this website does not constitute a recommendation to invest in or take out any of the products or services provided by any of the SMATS Group of companies. Click here for our Privacy Collection Statement and Privacy Policy.