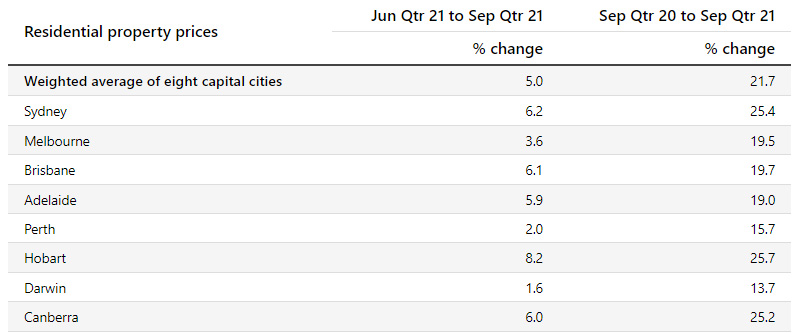

The Australian property market is enjoying a purple patch nationwide, with all major cities recording double digit growth for the year to September 2021 and the National Average growth of 21.7% being recorded according to the Australian Bureau of Statistics

Residential Property Price Indexes: Eight Capital Cities September 2021

Source: ABS

We were one of the few to predict continued growth despite the Covid-19 Pandemic and we forsee that this growth market will continue in the future, albeit at a slower rate of growth, for a number of key reasons including:

- Population Growth Returning

The Australian borders have been closed for almost 2 years and only just opened up again on the 22nd February 2022. We expect a strong level of incoming permanent migration to recommence and quickly build to previous high levels, putting more demand pressure into the market.

This will include the continuing flow of Australian expatriates that have been returning after many years abroad, most with significant savings and demand for lifestyle property.

- Soft Supply and High Replacement Costs

Covid-19 has significantly impacted supply chains worldwide, and the construction industry in Australia has been hit particularly hard, with escalating costs of materials and shortage of labour pushing building costs upwards.

Supply is the only real way you can moderate price rises in the general market and this remains a weak point Australia wide. Many projects due to commence will now be deferred as they may become less viable to construct in the current cost environment, putting even more pressure on prices.

The replacement cost, and also the delay in getting things constructed, will also keep established property prices high as there is an immediate need for many of the incoming migrants and returning expats need accommodations now, not later.

- Owner Occupier Boom

A big factor is lifting prices has been the surge in owner occupied housing as renters move to become owners, many for the first time.

This has had a double whammy effect of more demand from their activity and also a reduction in rental stock which as often been sold to an occupier and no longer available for rent. This has also helped significantly reduce vacancy rates across Australia and push up rents.

- Acute Shortage of Properties in Demand

Even though Australia has a strong construction industry, many of the new high density projects in the major markets of Sydney & Melbourne have not been suitable for the large pool of buyers looking to acquire. This is because many projects prove to be too small or less desirable for the discerning buyer looking for a nice place to live.

As such, an increasing demand for quality living property is being matched by a reducing pool of suitable properties, creating pressure on prices.

Some developers have recognised that and stated building much more liveable properties and have enjoyed strong sales success as a result, showing the mismatch in the market.

All of the above factors are likely to persist in the short to medium term and “split” the property market into two sectors, highly liveable and bearable.

Highly Liveable property will likely continue to enjoy above average returns for some time as it is difficult to increase the supply quickly to match the ongoing demand, whereas Bearable property will have value improvement whilst replacement costs stay high, but will likely underperform when similar supply continues to increase in this segment.

I am not concerned over potential interest rate rises on the overall market, especially in the Highly Liveable one where more affluent buyers tend to reign, as I do think Australia will still enjoy “below long term average” interest rates for some time, so it will have less an influence than some punters suggest.

At the moment, price points are becoming ever more attractive for current owners to consider existing the market and selling. It is indeed an attractive option at this time, however if you have something special in your property (location, view, build quality, potential regeneration in your area etc) then you are likely to be safe to stay in market and be rewarded with further lifts in values.

If you have a Bearable property, in an average area, then it is worth considering selling and perhaps “upgrading” your property at this time before prices of the Highly Liveable property segment become out of reach.

Either way, the market is most likely to hold gains and continue to improve, but perhaps moderate your future expectations. It would seem overly optimistic to expect too many years of double digit growth in the near future as price rise fatigue and buyer budget constraints will see a level of moderation and a slowing down of growth rates in a general sense, but special properties should still enjoy some above average growth as has historically been the case.

Our team at aussieproperty.com is available to assist you assess your current sale and rental values and ensure you are well supported in your decisions on acquisition, sale or management of your properties.

Click here to talk to our APC property professional in your area, as we have offices across Australia to make your life easier in accessing your piece of Australia.